Modernity has made finances more difficult and more complicated than previous generations could have imagined; wages have stagnated, foreigners jockey for jobs, and the cost of a family has increased with the increasing diversity. And to top it all off, the coronavirus lockdowns have created massive job uncertainty. What’s a dissident man to do? After all, creating a family requires resources. And that’s the goal: either create a family, or add to your family.

The answer is to treat it like lifting and dieting: start small, and improve incrementally.

When folks start a really restrictive diet with no preparation, they usually give up. When people try a really grueling lifting schedule with no lead-in, they usually give up. The same way you don’t expect a new lifter to bench 315 pounds from day one, you shouldn’t expect a new saver to immediately live an ascetic lifestyle.

Start small and manageable, and improve slowly. In that spirit: treat savings the same way you treat lifting. If you do, you’re infinitely more likely to succeed and stick to it long term.

So, I’m going to outline a “savings workout guide” for beginners. This guide is akin to the 5X5 lifting program: it doesn’t cover everything, but it’s a good place to start.

Let’s review the most common areas that typically wreck a budget:

a.) Car repair;

b.) Gifts;

c.) The portion of medical bills not covered by insurance and copays; and

d.) Various large purchases (often expensive shoes, expensive sunglasses, home appliances, tools, etc.)

The easiest way to set aside money for these categories is to automate it. I recommend creating separate bank accounts for each of the four categories listed above, and create recurring transfers from your “main” checking account to those other accounts. Again, those categories don’t cover everything, but it’s an excellent place to start.

For the medical and large purchase categories, I recommend creating bank accounts with a different institution than the one you normally bank with (i.e., the bank where your paycheck is deposited). The reasoning here is: inter-bank transfers usually take at least a day, so it will prevent you from raiding those accounts for impulse purchases.

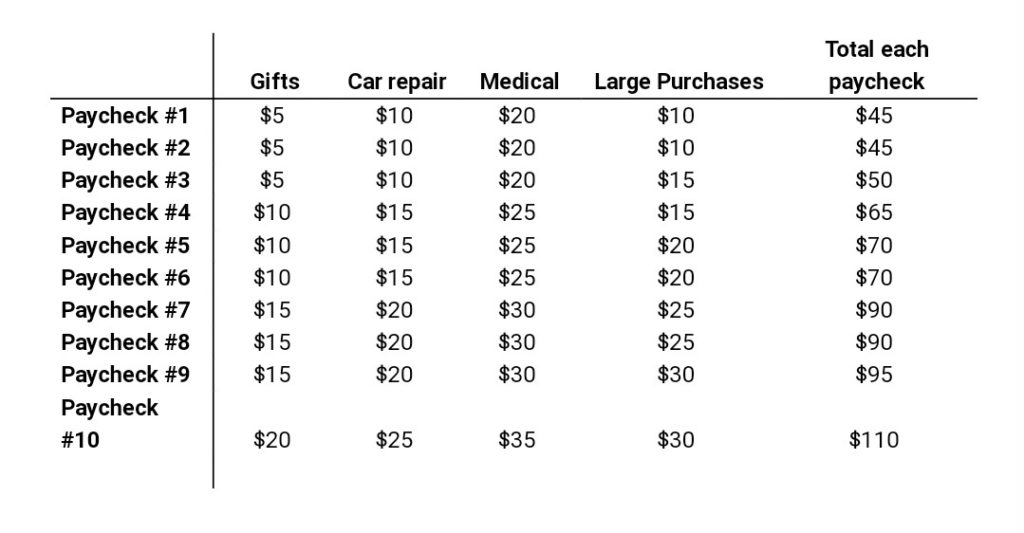

So, how much should you transfer to each account with each paycheck? Here’s a starter guide to get you started, but feel free to adjust the amounts depending on your income or how often you are paid:

If you’re new to savings or are trying to rebuild your finances, then try the guide above. The goal is NOT to solve your financial issues overnight, but rather give you the infrastructure and proper habits to help build your savings. Much like the 5X5 lifting program mentioned earlier, this is just a beginner’s guide to get you started and help you develop good saving habits. If that guide is not aggressive enough for your income level, then feel free to double or triple the amounts. But, keep in mind: savings are like a diet. Better to start off small and sustainable, and then gradually increase over time. That’s the key to building a life-long habit.

And you may ask: why hasn’t debt been mentioned? I’ll address debt in subsequent articles, but for the beginner, the goal is simply to build up reserves. If you focus exclusively on reducing debt, don’t save, and then have a car issue… well, you’ll be mighty tempted to swipe that credit card at the auto shop. Then you’ll be back at square one. Build up some savings first, then worry about debt.

Hopefully, the guide above seems easy enough and will allow the beginning saver to build up his finances and, ultimately, build a family as a result. A thriving Dixie cannot exist if her greatest proponents are scrambling from paycheck to paycheck, bill to bill.

May God bless you all during these trying times, and God bless the South.

-By Bellerophon

O I’m a good old rebel, now that’s just what I am. For this “fair land of freedom” I do not care at all. I’m glad I fit against it, I only wish we’d won, And I don’t want no pardon for anything I done.

Used this for many years, Slow and steady gets it done, do yourself a favor, Try it for a couple months, it really works and builds you psychologically,

The fact you are richer today than you were yesterday is essential.

God Bless the Republic