You can download and view the 2019 LTBO here at this link.

What is the Long-Term Budget Outlook (LTBO)? The LTBO is a document prepared each year by the Congressional Budget Office that makes projections for the next 30 years if things are to remain unchanged. The basic fact is, at this point, it doesn’t matter if things change drastically. There are no brakes on this train, there is nothing that can realistically be done to stop what is coming for the future of America. The rich and the elites fully intend to ride this crashing plane all the way to the ground. And, we, as Southerners, are passengers who find ourselves on this nose-diving aircraft.

Heads down, brace, brace, brace.

By 2050, the national debt is currently predicted to increase by 200%. No, I didn’t stutter, you read that right. I want to help you put that into perspective as to why this is alarming. The current national debt, in total, as of the 27th of August, 2019 is $22,472,360,797,329.80 or 22.472360797330000 × 10¹². A 200% increase looks like 4.494472159×10¹³ or $44,944,721,500,000 added on top of that original figure.

I know most people don’t like to do math, but math is very important to understand the problem we are facing because this is a numbers problem, just like demographic replacement is a numbers problem as well. If you remember your time in school, we use scientific notation to deal with very large numbers, but I’m gong to translate these and compare them with other items so you can truly wrap your head around exactly what we’re dealing with.

By 2050, and at the present course, the national debt will be 6.74170823×10¹³ or in long form, $67,417,082,400,000. That’s over 67 trillion dollars during your lifetime. To the average middle-class American, this is a number so large that it cannot really be comprehended. To the average middle-class citizen, something like $12,000 is a pretty good size of money to spend on something. To give you more perspective, the two most expensive things you, as the average middle-class citizen, will ever buy is the following – (a) your house and (b) your vehicle. Those, for the average person, are the two biggest expenses you will ever have. Keep in mind that for a low to mid-six figure house, you are paying it off over the course of, on average, 15 to 30 years.

A $235,000 home, with a 10% down payment, works out to a loan of $211,500. If you were to pay this off for 30 years, at an interest rate of 4.10%, you would be paying $1,022 a month. What could you do with an extra $1,022 a month? I’d gander a lot. What about the 15 year option? Well, at an interest rate of 3.43%, your monthly payments would come out to $1,505 a month. Even more, but over a shorter period of time. This is important to know because until that mortgage is paid off, you don’t own your house – the bank does. This is why during the housing crisis so many people ended up loosing their homes because the federal government allowed banking institutions to give out loans to people who truly couldn’t afford them or hope to pay them off. This created the housing bubble which ultimately popped.

To understand the national debt and how the United States has gotten away with it for so long, you need to realize how the rules for the modern economic system have been rewritten.

See, it used to be that when you wanted something you would buy it outright. This makes sense to most sane people. If you can afford it, you buy it. Later over the decades, it changed to – if you can afford the payments, then you can afford to buy it. For financially sound people, this is the mindset when it comes to making expensive purchases like a house or a vehicle. The problem is, when you do this, the money must keep flowing – to make the payments. Also, so long as you are making payments you truly do not own whatever it is you are making payments on, you are renting to own. This means if you fail to make the payments, the person or bank who gave you that money to finance your purchase can come and take it from you legally.

The whole process relies on your productivity in order to keep it moving. What happens if you get injured on the job and can no longer work? What happens if your employer closes its doors due to being undercut by another company, say in China for instance? Money is the only thing that matters in business, nothing more, nothing less. Everything else is just fluff meant to make you feel good about it. The power of the dollar, as they say.

But, where did this mentality come from? We know the players responsible for whispering it in the ears of society at this point. It used to be a time in the U.S. that it wasn’t just about profit margins managed by bean counters; things like having a living wage mattered and taking care of employees mattered. That isn’t to say there aren’t any businesses out there still like that, but you need to look hard to find them.

There used to be pride to make things here and buying things made in America. In the 1950s, a man could afford to buy a house and a vehicle, plus support his family all on his own. Meanwhile, his wife ran the family while he was at work. Virtually everything they bought was made in the U.S., and made with a high degree of quality. That world no longer exists and you can thank the elites for it.

Now these days, and unless you have a six figure job, that’s difficult and requires you to make sacrifices for your children on your end. A noble cause, but an unnecessary one, which I will explain – because the past alternative has been taken from you. Today, both you and your wife need to be working, if you want to live a good life in America. Even then, you will never truly be rich like the ruling class and the elites, unless it’s by a stroke of luck.

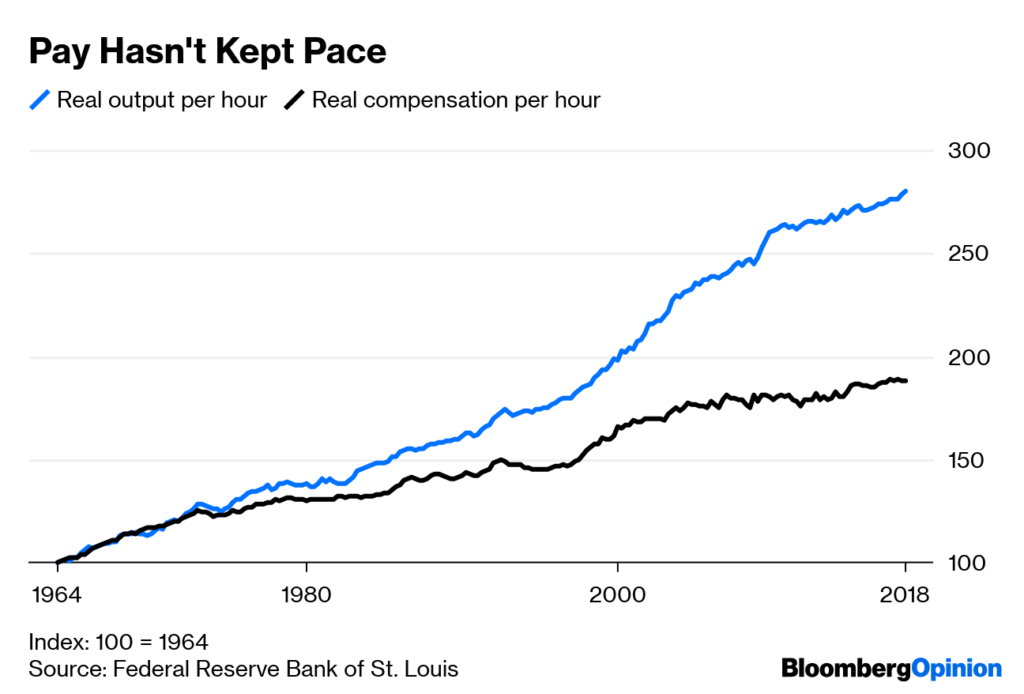

When did this start to change? During WW1 and WW2, when many men went overseas to fight, there was a major shortage of workers in the American economy. As a result, women entered the workforce. Laws preventing women from entering many industries were relaxed, societal and cultural norms, which through passive effect kept many women at home with the family, also began fading. This distinction is important to understand – how it impacted the labor market. In basic economics, the less of something that exists, the more valuable it is. The more of something that exists, the less valuable it is. This is ultimately the force which drives commodities. You can see it in the fluctuation of things like gas prices or milk. You can see it at the grocery store or market you buy your food.

This same rule applies with a labor force as well. The less workers you have, the more valuable they are and the more you have to pay to keep them. Competitive markets tend to, through natural effect, keep people honest; however, this is true when we aren’t talking about globalism. This applies to local or regional economies.

This is why people joined unions. The average person has been brainwashed to believe that some corporate board, stuffing their pockets as much as possible, is a good thing and you, the person working for them, having less money is a good thing too. That isn’t to say that there aren’t serious problems with unions, but unions have played an important part for our people. They emerged from guilds (of times of old), it’s not like they are a new thing. The pooling of resources and power gave workers leverage for a higher wage. Thus, they were/are better able to provide for themselves and their families. Don’t pay us enough? We will strike and then you won’t have any money, we all lose. The nuclear option. It was a system that kept the elite from getting too greedy.

The point is – economies are fine tuned machines which, just like the crankshaft of an engine, need to be balanced in order to prevent the engine from destroying itself. If the crankshaft is not balanced, the engine will destroying itself. This is where we are at right now.

An increase in labor force means companies need to be less competitive to get those workers. It means more people applying for the same position. For example, if I was to apply for a job as a mechanic for an airline, I’m competing against hundreds of people for the same position. No longer does the company have to try to market towards me, the worker, but instead can sit back as the workers come to it. In turn, the company gets to select who gives them the best value for their dollar. It’s not bad from a financial sense, the goal of a business is to make money and it needs to make money to survive. It’s not personal. This is why major companies appeal to the outrage mobs of the Left – because if they don’t, it hurts their bottom line. It’s not about doing the right thing or “pride” anymore, it’s about what makes the most money.

When you factor in globalism, a business is no longer tied down to an area. It can move if the market demands it. This used to not be the case. This means that a balance was struck and everyone ultimately won. When everyone wins in an economy (generally speaking), everyone is happy. This is why communism and state controlled economies are so appealing to people who have been left destitute by the ruling class and elites. If it’s one thing the Left gets right, it is a matter of class. When businesses started realizing they could pay less for workers because there was more of them, wages did not keep up with inflation spurred on by national debt. This is one reason why it seems that you can afford less than your Boomer ancestors because you truly have been cheated.

It’s important to understand how the national debt has been able to keep growing like it has and the lights have still stayed on. To do this you need to understand the difference between the gold standard and the fiat standard. It used to be, historically, for money to be worth something it actually had to be valuable. Actual currency was made from things like gold, silver, and other rare materials. It represented something physically valuable. The more gold you had, the more wealth you actually had as an individual. For countries, nations, kingdoms, etc., this used to mean that the value of their currency was tied directly to how much gold they had in their vaults. In other words, that paper dollar in your pocket was worth something because of the gold sitting in the vaults of Fort Knox. It wasn’t just a piece of paper, it was a physical manifestation of that gold. This system was sustainable because that paper money still had a real value attached to it and now it has an entirely different value attached to it – credit.

The fiat system works in principle by not having a physical value assigned to that currency, but rather a hypothetical value. What is that hypothetical value? It’s gross domestic production or GDP. GDP is a representation of all production in an economy. This is from goods to services. Goods are arguably the most important thing because it is something that is real, physical, and actually exists in the world you live in. Services is an artificial metric that represents a transaction of the potential to make money. My work is a service. It does accomplish something very real, but the value assigned to it comes from the performance of my work. The better I am able to do my job, the more valuable it becomes.

GDP takes into account all of these things when talking about an economy. GDP, in and amongst itself, is the total value of the economy. The bigger the economy, the more valuable it is. This is where the fiat system and credit ratings come into play. You have to understand credit in order to understand how the present system works. Credit represents the potential, as discussed earlier, to pay the bills. So long as things keep moving forward, the bills continue to get paid and the creditor is happy. The creditor, in this situation, is the one that has the real power because the creditor is the one who owns the product, until you have fully paid it off.

Who is the creditor in this case though? Mainly it is you, the tax payer. A majority of the national debt is owned, not by foreign countries, but the tax payer. The government is borrowing against your ability to pay that debt off through taxes. Athough, it’s more of your ability to pay interest payments on those loans it borrows against itself by printing more money. This naturally creates a cyclical problem where the system keeps “creating” money, making it worth less. Thus, when the national credit rating is downgraded it hurts everyone, except the elites.

The minute this process stops, the whole system falls apart. That is where we are headed if you read the LTBO report. This is the reason GDP growth is something that is harped on so much in the financial world. GDP must grow for the model to be sustainable. So long as the GDP grows, the credit score remains intact because the potential to pay off the debt exists. It is why they keep importing foreigners to replace you. Not just to ensure their power, but to also keep this system running for as long as possible while they stuff their pockets. That’s why there is still no wall. That is why the value of a dollar is ultimately the only thing that matters.

The problem is that when GDP slows or regresses this whole system sends ripples to everyone. Why is that? Because those at the top physically own what they need should it ever collapse.

Now you can begin to understand how multiple things tie into each other. It’s not just one thing, it’s the entire system as it stands now that is unsustainable. This is one of the reasons that the government is importing the world to replace you. To the elites, the “new Americans” are more valuable because it allows them to keep more money and power in their pocket. It’s not just because they hate you for being a white Christian.

The minute the GDP growth stops, the minute credit ratings for the U.S. falls, is when the whole system collapses. This is where we are headed – a dark age level of collapse far worse than anything that has ever been seen in all of human history. The reason for this is because the U.S. economy is the central pillar to the worldwide economy. Its collapse will effect everyone. This is why other countries work fervently to ensure the U.S. economy not only survives, but is able to grow at such a rate that keeps this whole system running. But, it can’t be done for much longer.

Under any financial situation, any economic model, it is impossible to pay off $67,417,082,400,000 in debt. It would take centuries. Many hard centuries of broken living in order to do so. This is all further exacerbated by other things in place you may not be aware of, such as mandatory federal spending. Out of the $3,645,000,000,000 the federal government took in during 2018, 64% of it went to mandatory spending. To give you an idea, these programs include things like Social Security, major health care programs, and other smaller programs codified and mandated to be paid by law. When you hear politicians arguing over federal spending, they are not talking about these mandatory programs. No, they are talking about the discretionary portion of the budget, the part the government has control over in terms of allocating spending. Wrap your head around that for a minute, the vast majority of spending cannot even be touched or used for anything else. Social Security, Medicare, and Medicaid account for 64% of the federal budget!

As these mandatory programs continue to increase, as you can see in the 2019 LTBO, their cost are going to go up.

God bless Dixie and God bless you.

To be continued…

I have seen three emperors in their nakedness, and the sight was not inspiring.

“But, it can’t be done for much longer.”

These vague predictions have been made since- I don’t know- Nixon taking us off the gold standard at least. Its true that “what goes up must come down” and “this too shall pass” , but predictions without time frame don’t aid planning and are not motivating. The U.S. can shamble along for a generation, a decade or a week. If it lasts 50 years our plans are different than if its kerploding next Tuesday!

Economists need to figure out what time frame we’re looking at, we already know collapse is inevitable one day.

I believe I already stated it in the article either directly or indirectly but let me give clarify it for you – the number I’m looking at is around 2050. It may happen sooner due to a variety of factors but that’s the big one I’m look at right now and as you know 2050 is about 30 years off at this point. I’m not even optimistic we will even make it that far given all the cracks that are beginning to show. It’s highly likely there will be no “America” as was once known during our lifetimes and my continuation piece will touch on what you can do to secure yourself and your family for the coming collapse.

I saw 2050 for when the budget would be unpayable, didn’t realise you were using that as the rough deadline.

It’s already unpayable. It’s been that way since Obama. There was a chance before him and his doubling of the dept that it could have been payed off. The main thing to look at is interest rates on outstanding loans the government has taken. That’s the real spark to the powder keg in this instance as so long as the interest payments are made everyone is happy. As we get closer to 2050 and the interest itself becomes unpayable, well that’s when the fun really begins…

I was at a “Town Hall” meeting in McAlester, OK hosted by Senator Coburn in August, 2010, at which he said then that we had about 15 months (if I recall correctly) before we reached the point where this would all be irreversible. Personally I thought it was already irreversible at that point, but took him at his word (realizing of course that nothing would be done in that time frame to change it, irrespective of Coburn’s dire warnings) since he was certainly more knowledgeable on the subject than me.

Right now the world seems to have entered a dreamlike stasis state. Hard to imagine anything changing.

Right now the world seems to have entered a dreamlike stasis state. Hard to imagine anything changing.